lake county florida sales tax

Lakeland FL Sales Tax Rate. The sales tax rate for Lake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Lake County Florida Sales Tax Comparison Calculator for 202223.

Florida Dept Of Revenue Property Tax Data Portal County Profiles

The State of Florida has a state sales and use tax of 6.

. There is no applicable city tax or special tax. There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation. The Lake City sales tax rate is.

What is the sales tax rate in Lake City Florida. If you purchased a home in 2022 you will receive a postcard from us once we have processed your purchase information. Sales tax in Lake County Florida is currently 7.

The most populous zip code in Lake County Florida is 34711. There was legislation to reduce the rate to 54 in 2021 however as part of the Covid-19 legislative package the state managed to pass delayed reduction in the commercial sales tax rental rate from 55. For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020.

Retail sales of new mobile homes - 3. You can print a 7 sales tax table here. Lake County Sales Tax.

The Tax Collector as an agent for the Florida Department of Revenue DOR collects sales and use tax on transactions when a customer applies for a title or transfers a title to motor vehicles mobile. The Florida sales tax rate is currently. Lake County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Lake County totaling 1.

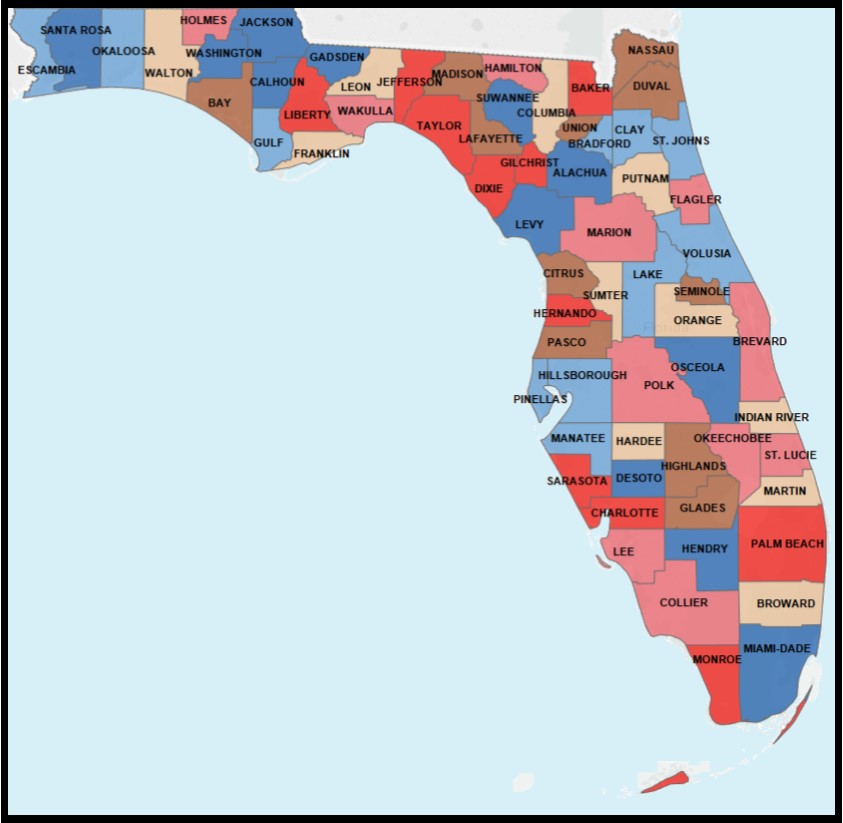

The Florida state sales tax rate is currently. 2022 Florida Sales Tax By County Florida has 993 cities. Tax Estimation Calculator.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Lake County Clerk warns residents of jury duty payment scam Posted. The Lake County sales tax rate is.

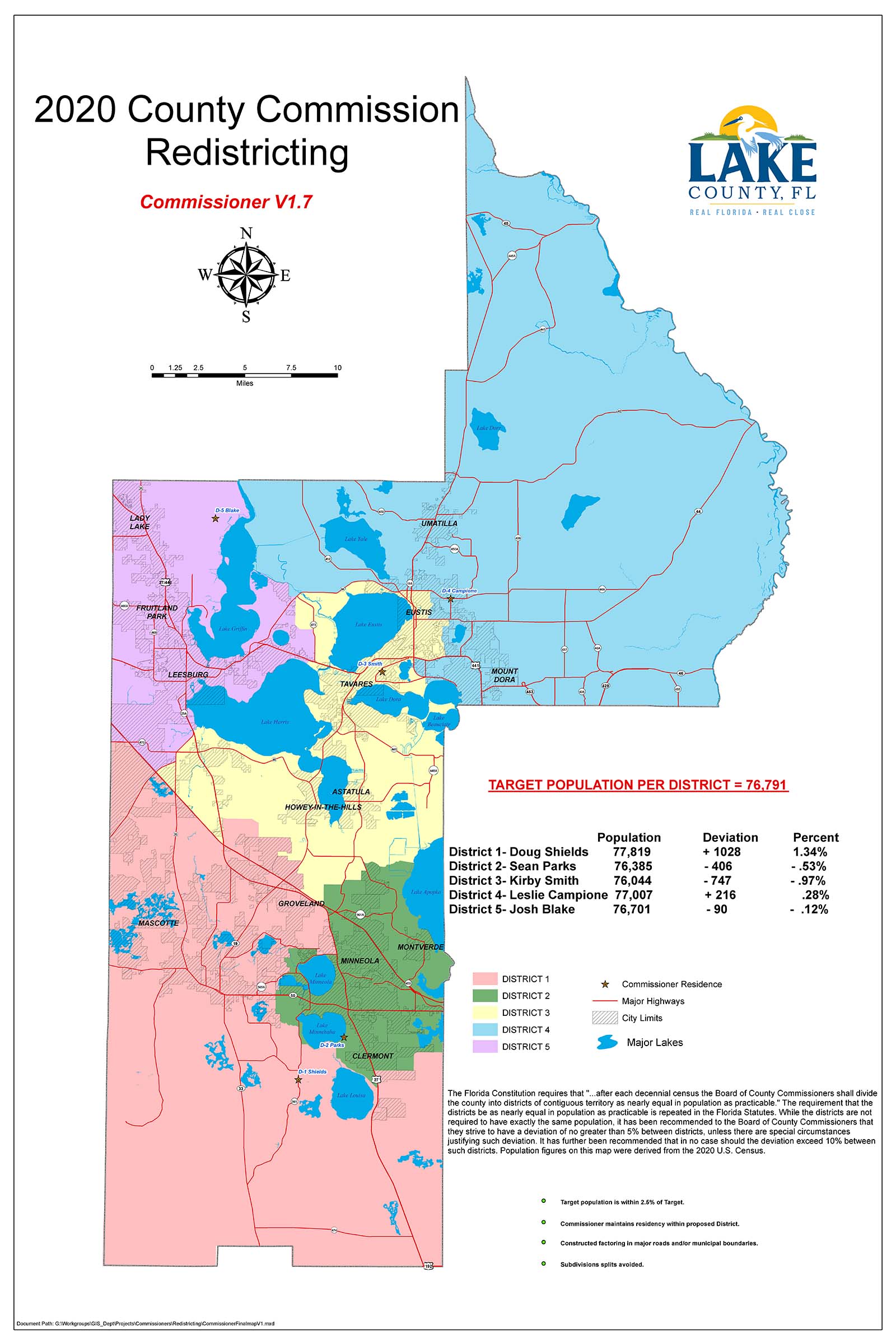

The most populous location in Lake County Florida is Clermont. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties within the municipalities and unincorporated areas of Lake County Florida. If this rate has been updated locally please contact us and we will update the sales tax rate for Lake County Florida.

You can find more tax rates and allowances for Lake County and Florida in the 2022 Florida Tax Tables. In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax. Lake County has an additional 1 Discretionary Surtax on the first 5000 of the purchase price for a maximum of 50.

6 rows The Lake County Florida sales tax is 700 consisting of 600 Florida state sales tax and. The minimum combined 2022 sales tax rate for Lake City Florida is. If you purchased your home in 2021 and failed to file timely file online now.

Jordan Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone. Amusement machine receipts - 4. 6686076 email addresses are public records.

Automating sales tax compliance can help your business keep compliant with. Tax Deed sales are administered by the Clerks Office at the Lake County Public Records Center. The current total local sales tax rate in Lakeland FL is.

Past taxes are not a reliable projection of future taxes. Floridas general state sales tax rate is 6 with the following exceptions. 201 West Burleigh Blvd Tavares FL 32778.

The average cumulative sales tax rate between all of them is 7. Tax Certificates are sold yearly by the Tax Collector on properties with delinquent taxes. 23 rows The total sales tax rate in any given location can be broken down into state county city.

For several years the state reduced the commercial rental sales tax rate small amounts with a reduction to 55 plus the local surtax effective January 1 2020. Complete applications may still be eligible for the 2022 tax-year. To review the rules in Florida visit our state-by-state guide.

The 2018 United States Supreme Court decision in South Dakota v. For tax rates in other cities see Florida sales taxes by city and county. The current total local sales tax rate in Lake County.

3 rows Lake County FL Sales Tax Rate. Tavares Florida 32778 Phone. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes.

The 7 sales tax rate in Lake City consists of 6 Florida state sales tax and 1 Columbia County sales tax. 2018-33 Proposed 15-Year Sales Tax Capital Plan. The County sales tax rate is.

Has impacted many state nexus laws and sales tax collection requirements. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. The sales tax rate does not vary based on location.

A full list of these can be found below. This is the total of state county and city sales tax rates. If you need access to a database of.

You may then pre-file for your 2023 tax year homestead exemption.

Tax Information Lake County Property Appraiser

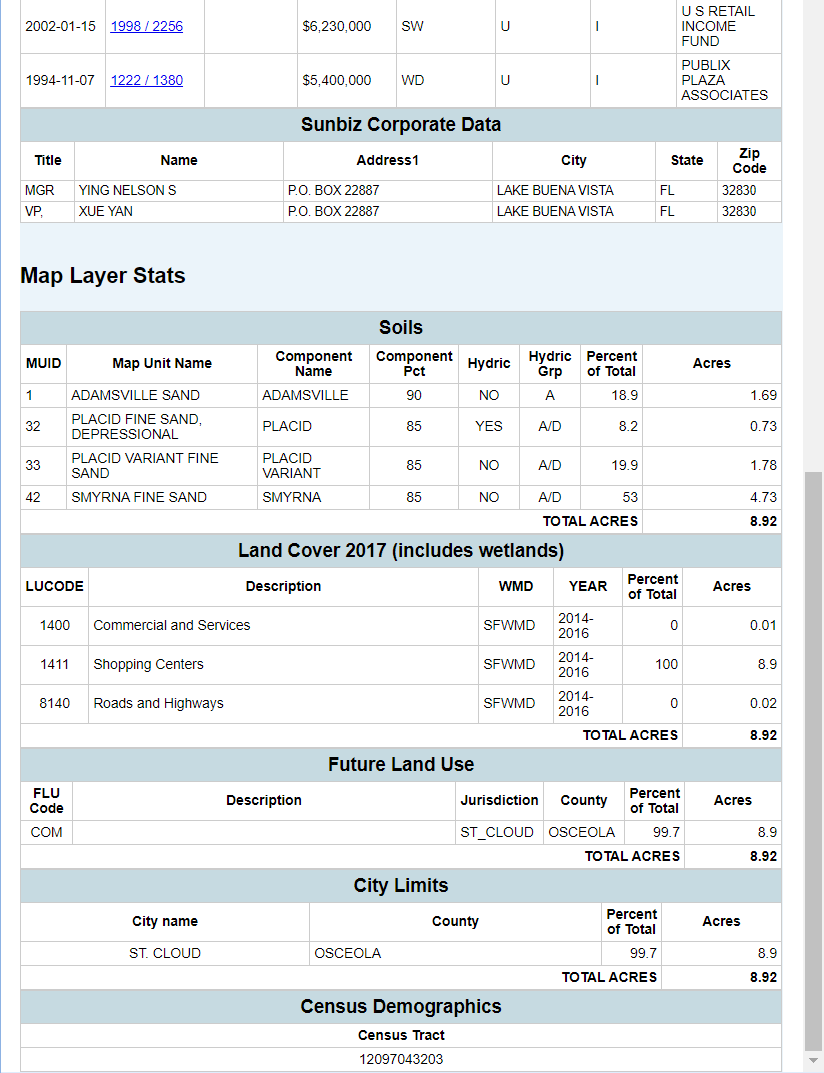

Lake County Fl Property Data Real Estate Comps Statistics Reports

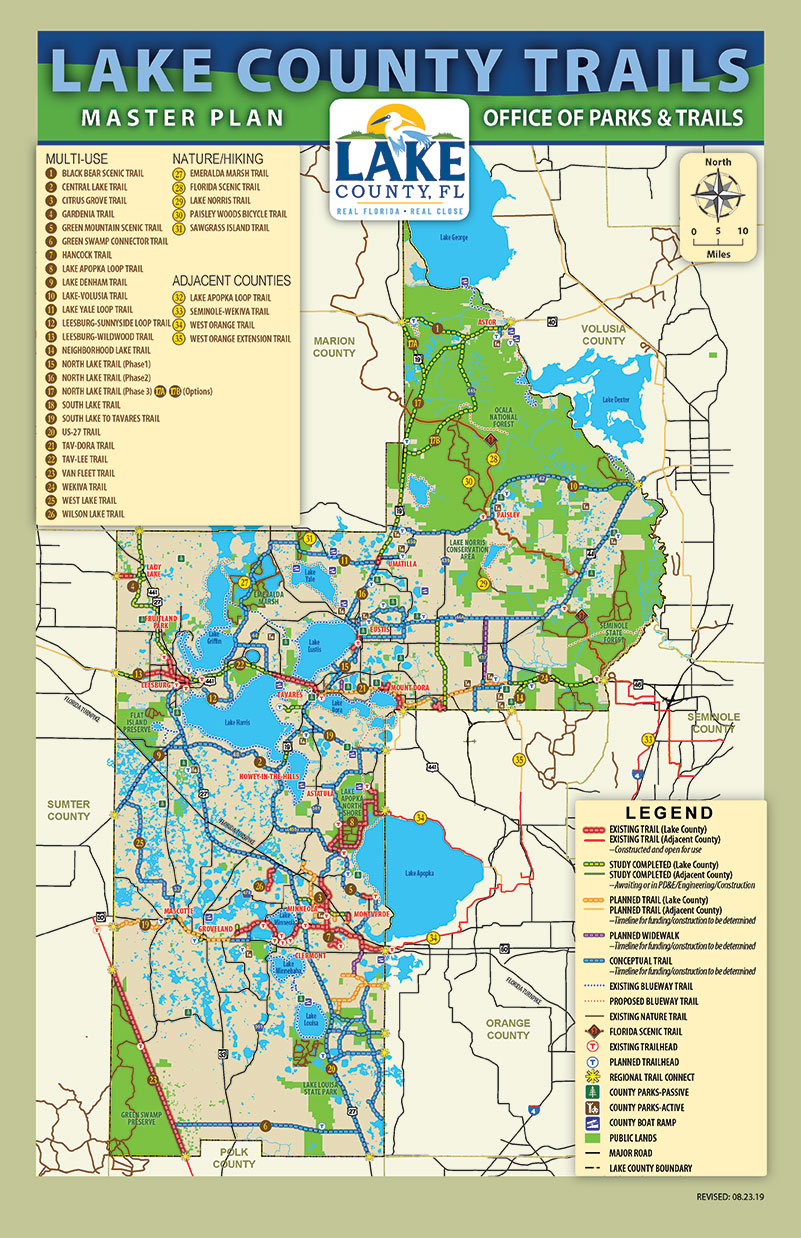

Lake County Economic Development

Florida County Property Appraiser Search Parcel Maps And Data

Motor Vehicles Lake County Tax Collector

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Florida Sales Tax Rates By City County 2022

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Motor Vehicles Lake County Tax Collector

How To Calculate Fl Sales Tax On Rent

Motor Vehicles Lake County Tax Collector